Meanwhile, consider going Long only if the price is in the uptrend and the stochastic is below 20. Therefore, remember to sell only if the price is in the downtrend and the stochastic is above 80. On the other hand, if the stochastic levels are below 20, then that means the market is oversold and the price will likely bounce in the future. In this case, when the stochastic levels hit 80, that means too many traders have invested and the prices are more likely to move lower. The stochastic indicator is essentially used to identify oversold and overbought conditions. Just make sure that you're not overtrading.Īs an addition, you can add stochastic with a setup of 14, 3, and 5 to your chart. Or you can just use the 4-hour and 1-hour charts as your guide. You should just wait and be patient until all the time frames show the same trend.

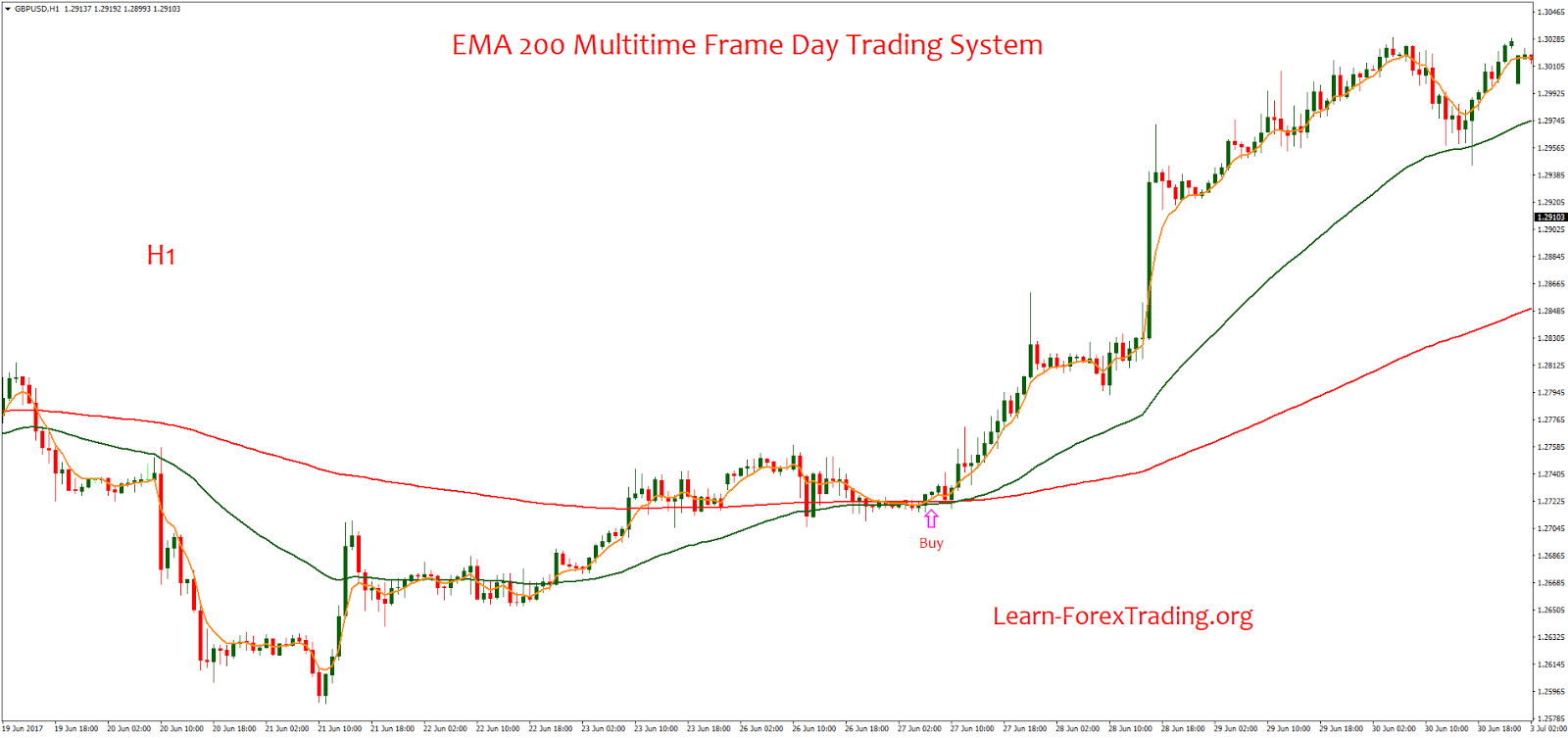

If the trend in the 1-hour chart is different from those on the daily and 4-hour charts, you should just wait for the trend to shift and turn in the same direction.In trading with three charts simultaneously, remember these two rules: Also, make sure to use the principle of buy low and sell high as we have previously mentioned. If the correlation is present in all three time frames, then it is a good time for you to open a position in the 1-hour chart. Make sure that the 200 EMA has the same trend as in the two previous time frames. If you can see that there is a clear correlation, switch to the 1-hour chart and repeat the process. In this case, you would want to look for the 200 EMA correlations with the daily chart. Now shift to the 4-hour chart and see where the 200 EMA is relative to the price. The next step is to confirm the trend in the shorter time frames. In this case, the daily chart is used to identify the main trend. On the other side, when the price is above the 200 EMA line, then it is an uptrend. The steeper the EMA slopes, the stronger is the trend. Basically, the main principle is that if the price is below the 200 EMA line, then it is a downtrend. Now that the 200 EMA is already set, you should identify the trend in the daily chart. Note that this trading strategy is a multi-time frame one, so in this case, you will need a daily chart, 4-hour chart, and 1-hour chart. The first step is to set the chart with the 200 EMA. Also, if you are able to spot major market movements, 200 EMA will help you execute positions based on large swings. The basic trend principle to remember is to buy low and sell high. The 200 EMA is a long-term indicator, which means it will help you identify and trade with the long-term trend.

#200 ema indicators telechargement gratuit how to

How to Trade with 200 EMA Trading StrategyĪs the name implies, the 200 EMA trading strategy is based on the Exponential Moving Average set with a period of 200. This article will explain how to trade with the 200 EMA trading strategy along with its advantages and disadvantages. In contrast, the longer the period, the less sensitive the results are.Ģ00 EMA is one of the most well-known EMA periods to use in the forex trading strategy because it is quite simple and has the potential to tell many important price information.īesides, this strategy is definitely worth noting due to the psychological effect that can occur in the market's price movements around the 200 EMA line. The shorter the period, the more sensitive the indicator line to price movement.

Like other MA types, EMA is a customizable indicator, meaning that traders can freely choose their periods. Compared to other strategies, it is relatively easy to learn and use, making it suitable for both beginners and professionals.īasically, Exponential Moving Average (EMA) is one of the most commonly used indicators in forex trading. If you're still unsure about which strategy suits you best, you might want to try the 200 EMA trading strategy.

Many traders like to jump around while trying different strategies and end up quitting. How to use 200 EMA as a simple but powerful strategy? Despite its common setups, there are good trading opportunities to find if you can utilize 200 EMA properly.Īs a trader, ing a suitable and effective trading strategy is definitely not the easiest task.

0 kommentar(er)

0 kommentar(er)